Money conversations in marriage shape not just your financial future, but the very foundation of your relationship. When merging finances with your partner, success lies in creating a system that honors both individual autonomy and shared goals. Studies show that couples who openly discuss money and maintain joint financial planning are 50% more likely to report higher relationship satisfaction. Yet, the journey toward financial unity requires more than just combining bank accounts—it demands trust, communication, and a shared vision for your future together.

Think of joint finances as a dance where both partners must move in harmony while maintaining their unique rhythms. Whether you’re newlyweds navigating your first shared budget or long-term partners seeking to strengthen your financial bond, the key lies in building a framework that reflects your values as individuals and as a couple. This guide will walk you through essential strategies for creating a robust financial partnership that enhances, rather than complicates, your marriage.

Let’s explore how to blend your financial lives while preserving the independence and respect that keep your relationship thriving.

Having ‘The Money Talk’ Before Combining Finances

Financial Values and Goals

Building a strong financial foundation in marriage starts with having an open conversation about your values and goals. Think of it as creating your family’s financial mission statement – what matters most to you both? Maybe you dream of buying a home together, starting a family, or traveling the world. Whatever your aspirations, getting on the same page early is crucial.

Set aside time for a “money date” where you can both share your financial priorities without judgment. One partner might value security and saving, while the other prioritizes experiences and living in the moment. Neither approach is wrong – it’s about finding common ground and creating shared goals that honor both perspectives.

Break down your goals into short-term (1-2 years), medium-term (2-5 years), and long-term (5+ years) objectives. This helps make your dreams more tangible and actionable. Consider creating vision boards or maintaining a shared document where you can track your progress together. Remember, your financial values may evolve over time, so schedule regular check-ins to reassess and adjust your goals as needed.

The key is maintaining open communication and supporting each other’s financial dreams while working toward your shared future.

Debt and Credit History

Let’s address the elephant in the room – debt and credit scores can be a sensitive topic when merging lives together. I remember feeling nervous about sharing my student loan details with my partner, but transparency is crucial for building a strong financial foundation together.

Start by having an honest conversation about your individual credit histories. Pull your credit reports together and review them as a team. This isn’t about judgment; it’s about understanding where you both stand and creating a plan forward. Whether it’s student loans, credit card debt, or a car payment, knowing the complete picture helps avoid surprises down the road.

Consider how your credit scores might affect joint goals like buying a home or applying for loans together. If one partner has a lower credit score, work together to improve it through consistent payments and responsible credit use. Some couples choose to keep certain debts separate while working as a team to pay them down, while others combine everything – there’s no one-size-fits-all approach.

Remember, you’re partners now, and tackling financial challenges together can actually strengthen your relationship.

Creating Your Joint Financial System

Choosing Account Structures

When it comes to managing money as a married couple, there’s no one-size-fits-all solution. From my experience working with couples, I’ve found that the key is finding an account structure that aligns with both partners’ comfort levels and financial styles.

Many couples opt for the “yours, mine, and ours” approach, maintaining individual accounts for personal spending while sharing a joint account for household expenses and shared goals. This setup can be particularly appealing for couples who value financial independence alongside their shared commitments. Lisa and Mark, a couple I recently spoke with, shared how this arrangement helped them avoid money-related tension while still working together toward their family goals.

Others prefer to fully combine their finances, merging all accounts into joint ones. This approach can simplify budgeting and create a stronger sense of financial unity. However, it requires excellent communication and mutual trust to succeed.

A third option is keeping finances completely separate while developing a clear system for sharing expenses. While less common, this can work well for couples who married later in life or have complex financial situations.

The most important aspect isn’t which structure you choose, but rather that both partners feel comfortable with the arrangement and that it supports your shared financial goals. Remember, you can always adjust your approach as your needs and circumstances change.

Bill Payment and Expense Sharing

When it comes to managing shared expenses, having a clear system in place can prevent countless disagreements and stress in your marriage. From my experience working with couples, the most successful approach is creating a structured yet flexible bill payment system that works for both partners.

Consider setting up a joint account specifically for household expenses, where you both contribute either equally or proportionally based on your incomes. Many couples I’ve worked with use the 50/30/20 rule: 50% of each person’s income goes toward joint expenses, 30% for individual spending, and 20% for savings and investments.

Technology can be your best friend here. Use apps like Splitwise or Honeydue to track shared expenses and ensure everything’s divided fairly. Set up automatic payments for regular bills to avoid late fees and reduce the mental load of remembering payment dates.

Regular “money dates” are essential for reviewing expenses and adjusting your system as needed. Maybe one partner handles the daily expenses while the other manages long-term investments, or perhaps you prefer to tackle everything together. The key is finding what works for your relationship dynamic.

Don’t forget to build in some flexibility for unexpected expenses. Having an emergency fund that you both contribute to can help prevent financial stress when surprise bills pop up. Remember, the goal isn’t just about splitting bills – it’s about creating a partnership where both people feel secure and respected in their financial decisions.

Building Trust Through Financial Transparency

Regular Money Check-ins

Just like your weekly coffee date or monthly dinner tradition, scheduling regular money check-ins with your spouse is crucial for maintaining financial harmony. I’ve found that couples who make time for effective financial discussions tend to feel more connected and secure in their relationship.

Consider setting up a monthly “money date” – it doesn’t have to be formal or intimidating! Pour your favorite beverage, get comfortable, and review your financial picture together. During these check-ins, discuss your progress toward shared goals, review recent expenses, and address any concerns before they become bigger issues.

Here’s what to include in your regular check-ins:

– Review joint account balances and recent transactions

– Track progress on savings goals

– Discuss upcoming large expenses

– Share any financial concerns or victories

– Update your budget as needed

– Plan for future investments or purchases

Remember to keep these conversations judgment-free zones. If something isn’t working, focus on finding solutions together rather than pointing fingers. Many couples find it helpful to use shared budgeting apps or spreadsheets to keep track of their finances between check-ins, making these discussions more productive and focused.

The key is consistency – whether you choose weekly quick chats or monthly deep dives, stick to your schedule and treat these financial check-ins as non-negotiable appointments with your partner.

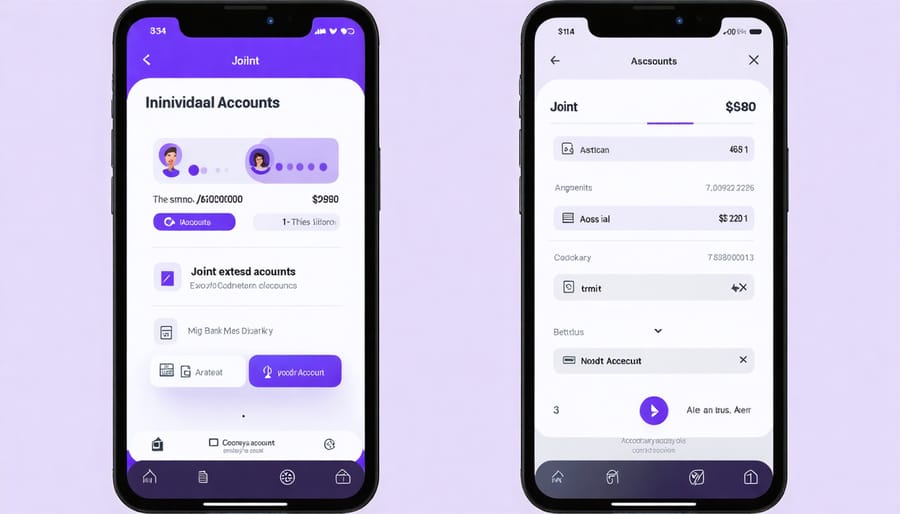

Shared Financial Tools and Apps

In today’s digital age, managing joint finances has never been easier thanks to numerous apps and tools designed specifically for couples. My husband and I discovered that using shared financial apps actually brought us closer together financially and helped eliminate those awkward money conversations.

One of our favorites is Honeydue, a free app that lets couples view all their accounts in one place and even allows you to set spending notifications. Think of it as your financial love language translator! Another popular option is Mint, which offers comprehensive budget tracking and goal-setting features perfect for couples working toward shared dreams like buying a house or planning that dream vacation.

For splitting everyday expenses, apps like Splitwise can be a lifesaver, especially during the transition period when you’re just beginning to merge your finances. We’ve found that using digital tools like Zelle or Venmo makes transferring money between accounts quick and stress-free.

For investment-minded couples, Fidelity and Vanguard both offer excellent joint investment account options with user-friendly interfaces. Many couples also swear by YNAB (You Need A Budget) for its robust planning features and philosophy of giving every dollar a job.

Remember, the best tool is the one you’ll actually use consistently. Start with one app that addresses your most pressing financial need, and gradually expand your digital toolkit as you become more comfortable managing money together.

Navigating Financial Differences

Balancing Individual Freedom with Joint Goals

Remember when you first got married and worried about losing your financial independence? I’ve been there! The key to successful joint finances isn’t about giving up your individual identity – it’s about finding the sweet spot between personal freedom and shared goals.

Many couples find success with the “yours, mine, and ours” approach. Consider maintaining separate accounts for personal discretionary spending while pooling resources for household expenses and shared dreams. This way, you can still buy those concert tickets or invest in your hobby without feeling guilty or explaining every purchase.

Set a monthly “no questions asked” spending allowance for each partner. Whether it’s $100 or $1,000, having this financial breathing room prevents resentment and promotes trust. Just make sure the amount works within your overall budget and feels fair to both parties.

Regular money dates are essential for checking in on both individual and shared financial goals. Use these conversations to celebrate personal wins while ensuring you’re still aligned on major objectives like homeownership or retirement planning. Remember, successful couples view financial independence not as a threat to their partnership but as a healthy aspect of a modern marriage.

Compromise and Communication Strategies

Money talks can be tricky, even in the strongest marriages. The key to successfully managing joint finances lies in mastering the art of resolving financial disagreements through effective communication and compromise.

Start by scheduling regular “money dates” – peaceful times when both partners can discuss finances without distractions. During these conversations, practice active listening and avoid becoming defensive. Remember, you’re on the same team working toward shared goals.

When conflicts arise, try the “pause and reflect” method. Take a step back, acknowledge each other’s perspectives, and focus on finding middle ground. For instance, if one partner is a saver and the other a spender, consider creating separate “fun money” accounts while maintaining joint accounts for shared expenses.

Use the “trade-off” technique when making financial decisions. If one partner wants to make a significant purchase, discuss how it affects your shared goals and find ways to balance it with the other partner’s priorities.

Consider using the “three-option approach” when facing financial decisions: each partner presents their preferred solution, then together you create a third option that incorporates elements from both sides.

Managing joint finances in marriage is truly a journey that’s best traveled together. Just like any other aspect of your relationship, financial harmony requires open communication, mutual trust, and a shared commitment to your goals. Remember, there’s no one-size-fits-all approach – what matters most is finding a system that works for both of you and staying flexible as your needs evolve.

Think of your joint finances as a garden you’re tending together. Some days, one partner might do more watering while the other focuses on weeding, but ultimately, you’re both working toward the same beautiful outcome. The key is maintaining that spirit of partnership, even when facing challenging financial decisions or unexpected expenses.

As you embark on this financial journey together, celebrate your small wins and learn from any setbacks. Schedule regular money dates to review your progress, adjust your strategies, and dream about your future together. Whether you’re just starting to merge your finances or looking to strengthen your existing system, remember that you’re building something special – a strong financial foundation for your shared life ahead.

Start today. Have that first conversation, set up that joint account, or create that shared budget. Your future selves will thank you for taking these important steps together.